Before we jump on the charts and start looking at the practical side of Support & Resistance, its important we cover the theory part first. Teaching Support & Resistance can be a very controversial subject as so many traders teach it in the different ways. The main reason for this is because support & resistance can be measured in many different ways. A good example of this is when I asked a programmer to build me a support & resistance indicator and his reply was how do you want the indicator to measure support & resistance? This stopped me in my tracks, because I realised then, you can draw Support & Resistance in many different ways. A quick google search confirmed this with over 64,000,000 search results and many different Support & Resistance terms.

Now do not be worried! Your not going to be spending the rest of your time here learning all the different terms, and then being questioned about them at a later date. If you know me by now, you know I like to keep trading simple. I have a saying in trading that chart time is everything. The goal here is to be able to spot the Support & Resistance levels on your charts, not name everyone of them. The problem with teaching trading, is many different people will call the same thing, many different names and this causes massive confusion. I have lost count of the amount of hours I have lost listening to other traders trying to explain how they trade, to only find out its just Support & Resistance.

A very good example of this is below. I have took this screenshot from a very famous SMC trader who teachers traders to trade. Now I’m going to tell you first that I have the upmost respect to every trader who trades. We are all in this industry to make money together, so how people trade is totally up to them. I will never dis-respect anyone, and will always welcome other traders with open arms regardless of how they trade. However this is a very good example of what I’m trying to teach you.

The example above is a buy trade based of a trading method called Smart Money Concepts or SMC for short. This method of trading is considered a very technical way of trading, and very confusing to understand. The method behind the strategy is to identify where the institutions would buy and sell from. SMC uses words such as Order blocks, FVG, Imbalances, LIQ, BOS, COCH etc. Now I’m not saying this method doesn’t work because clearly it does as many traders have mastered it, but now let me show you what I see on the charts.

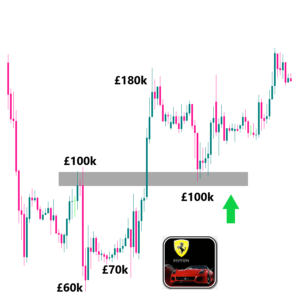

The same setup and same example as the previous one. However even though we would take the same trade as each other, my method and what I see is different to his. Lets firstly start off by looking at the red arrow. For me this is a perfect sell with the trend. As price comes up to the ‘red arrow’ I can clearly see that price is in a down trend. I can see this by firstly looking at the support line which is broken, but secondly also the lower lows and lower highs being formed. Combine this all together and you have a perfect example of a break and retest of a support line and a sell with the trend. Now the next part is very important, but also very simple once you break it down. For price to be into a down trend, you need lower lows and lower highs, however from the example above, you can see that price really struggled to go any lower than the previous low. This would indicate to me that perhaps there is a major a support level there, and buyers are starting to come back into the market.

This is normally when I would go down to the lower time frames and look for resistance to be broken to the upside. This is because if price is in a down trend then support will get broken, and if price is in an uptrend then resistance will get broken. As you can see by the green arrow, that in fact resistance did get broken and then price retouched that level to create a break-retest to the upside. When you line all the dots together now from price failing to go lower, price then creating a higher high and breaking a resistance level, you can see why a buy at that green arrow was perfect. For me I could see two possible entry points on that chart. Both with the trend. However the important thing to remember is every trader will call and see things differently on the charts. Where a trader might see an SMC setup, I see Support & Resistance.

At the end of the day no one is right and no one is wrong. The goal of trading is to make money, and how you make that money is up to you. You just have to remember that the Forex Market has been around for generations, so what you learn on the charts has been around for years. If you went to school to learn to trade, then the teacher who taught you was once a student of their teacher. Then that teacher was a student of their teacher. Then before you know it after 50 years the original strategy, has been taught and changed to create many more different strategies, as each teacher adds their own personal touch to it.

A famous saying is “The thing that hath been, it is that which shall be; and that which is done is that which shall be done: and there is no new thing under the sun.”

After you spend years on the charts and build up the experience you will learn to understand this. Many traders talk to me with words I do not understand, however once I see on the charts what they are doing it all makes sense. Going back to the example above. It does not matter what you call it, the key thing here is about identifying the levels and being being able to profit from them.

We covered this earlier in the course where I talked about the Rabbit, and the Duck illusion and how some people see a duck and others see a rabbit. The example above is a perfect example of that. Some see an SMC concept, and others see a Support & Resistance concept. The problem gets worse when you see both concepts. I have taught thousands of traders, and a big problem traders have is sometimes knowing too much. I know this sounds strange at first because we should never stop learning, but sometimes when I’m teaching Support & Resistance, some traders will start talking about something else to me. This is one of the reasons why I do not follow anyone else, as It will just confuse my vision and goals in trading.