In this section your going to learn the importance of Supply & Demand levels and how they are are key to your success in trading. However before we deep dive into the subject we are firstly going to review what you learnt in the previous section regarding Highs & Lows in the market. Highs & Lows are so important in trading because they represent key levels of support and resistance, which can provide valuable information about the strength and direction of the market. This is why we are going to continue with this subject until you truly understand it.

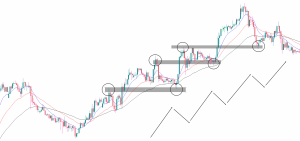

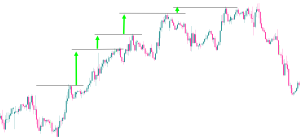

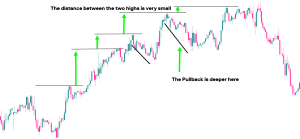

Highs and lows are important in forex trading because they provide traders with important information about the market trends and the direction of the price movement. By identifying these key levels, traders can determine the strength of the market, the levels of support and resistance, and the potential price targets for their trades. For example, if a currency pair has been consistently reaching higher highs and higher lows, this is a sign of an uptrend, which suggests that traders should look to buy the market. Conversely, if a currency pair has been consistently reaching lower lows and lower highs, this is a sign of a downtrend, which suggests that traders should look to sell the market.