So going back to the conversation explaining how institutions enter a trade. As you have just seen, banks, institutions and hedge funds are trading with hundreds of millions of dollars. For them they simply can not enter a trade at the click of the button. The main reason is because small trades are absorbed by each other as traders are buying and selling every second of the day. However when an institution wants to sell $500 million dollars worth of EURUSD, there is not enough liquidity on the other side of the trade to absorb that amount of volume. Remember every trade you take there will be someone else on the other side of that trade, whether that is another trader or broker. If you take a buy, someone sold you that buy. However if someone wants to sell $500 million dollars, there is not enough volume on the other side to buy that amount. Therefore this becomes a big problem for the institutions.

To overcome this problem they do two main things.

Buy in blocks

Rather than taking one large trade at $500 million dollars worth, they will break that one large trade down into smaller traders. Perhaps 5 x $100 million dollar trades. This does a number of things. The first one it means they can enter trades at different price levels, and they can buy and sell at the correct prices they want. If they were to sell $500 million in one go, it would move the market that much, they would not be buying at the price they want to. Other Traders would see that volume coming into the market, and price would move before they had a chance to sell all $500 million dollars. The second reason why breaking it down into smaller trades makes sense, means the market is absorbing that amount of volume. If the market can not absorb that amount of volume, you get something called an imbalance.

Use Liquidity

If you have ever traded the stock market, you will know that small stocks can be manipulated easy. In fact this is what most institutions are trading as they can profit from them quite easily. A common occurrence amongst smaller stock companies is the pump-and-dump scheme. This is where a group (often a brokerage firm) will send out a strong buy alert to all of their clients, to artificially inflate the price, only to dump all of their holdings for huge profit, sending prices back down to the detriment of their clients’ trading accounts. Lets say for example an institution has a large profitable position in a small company called X. For the institution to sell their position in that stock, there needs to be buyers in that stock winning to buy at the level the institution wants to sell at.

So how do they recruit buyers?

The answer is simple. Most mainstream media outlets are owned by institutions and most institutions also have people on forums like Redditt and other stock trading related social media platforms. All they need to do is report some positive results on that particular company, to peek traders interest to buy that companies stock. That amount of buying pressure on that companies stock means the institution can off load their sell position onto the newly recruited buyers. Its a sneaky trick to do, but it works and happens all the time!

Now Forex trading is a little different as not one single entity can move and control the market. So what they do is very similar. Lets say for example GBPUSD (example above) is in a downtrend and a institution wants to sell it too. They know they can not sell $500 million dollars in one go as everyone else is selling too. So they need to recruit buyers. As a trader with experience, its pretty obvious when price starts to pullback, that everyone is going to be selling when price comes up to an area of resistance. At the end of the day, trade with the trend as the trend is your friend!

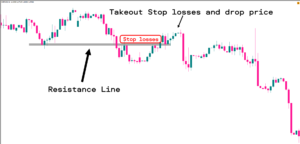

Now if everyone is selling at a resistance level because its with the trend, where do you think they are going to be putting their stop losses? Exactly! Just above that resistance area.

Smart traders know this and if they can push price higher enough to take out those stop losses, it means the institution can now buy all those sells that are being stopped out and they can finally offload their $500 million dollars.

Again its a very smart thing to do, but the institutions have to do this for them to be able to enter sells too.

Do Not Be Fooled

Over the recent years, many Gurus on YouTube have tried to sell courses teaching you this exact method and theory. Brain washing beginners into thinking price is always manipulated and unless you trade like an institution you will not make money. Trade liquidity or become liquidity is a very popular saying I have heard in recent years. However you need to understand these main things.

Firstly looking at the example above and see how GBPUSD was in an downtrend, and notice how institutions sold it too? This confirms one thing. Institutions, banks and hedge funds also trade with the trend. Something so basic and simple as trend trading, yet both retail and institutions do it. The main reason for this is because you always want to trade with the momentum of the market. Swim with the current not against it.

The second thing to look at is for an institution to enter a market, they have to create buyers for their sell positions. This is a perfectly normal thing to do and it happens every day in the market. A beginner would panic and quickly sell with the trend while a smart patient trader will wait for a pullback and enter at a better price. That is about as simple as it needs to be. It does not need to involve a £5,000 course teaching you this, that other mentors will charge you.

The last thing to consider is institutions are actually marking up areas of Support & Resistance on their charts, which actually goes against the belief that institutions don’t see Support & Resistance. However this is simply not the case. Most Support & Resistance levels will have stop losses above and below them, and that is 100% fact. So if a institution wants to enter the market, they know where the liquidity is going to be.

So how do we trade Support & Resistance successfully?

Well you are about to learn that in this course!