Compound Interest

Why teach people if you make so much money from Trading?

Since setting up the Binary Destroyer I have always been asked “Why do you teach people to trade if you make so much money from trading?”. The answer is easy – when you discover a skill as powerful and life changing as trading, you feel the need to share it with the world. I am a huge believer of the fact that EVERYONE has a higher purpose, but the vast majority are too busy “making a living” to find what that is. I look around and see everyday people spending half of their waking lives exchanging their valuable time for money, in order to put a roof over their head and food in their stomach. As traders, we are able to make exponentially more income than the average worker, simply by spending a couple hours per week on our computers. This is a skill I learnt myself from home, and I feel that it is my duty to pass it on to whoever is committed to learning.

Most successful traders will go down this same path and setup a business that involves Forex Trading, whether that is training, or account management etc. 20 years ago Forex trading was reserved for the high net worth bankers on Wall street and getting into trading from home was near impossible. Now thanks to modern technology and some very helpful traders, it has now become accessible for everyone. When you become a successful trader, and I say WHEN because if you really want to become successful you will make it happen. I hope you too share your skills and experience to the generation below you. You understand once you have achieved wealth that the goal in life was to never be rich. It was to be happy and content with life and what you do day to day defines you as a person. Trading 2 hours a day and then sitting on the beach for the other 22 hours drinking cocktails is fun for about 3 days, and then it gets boring. I’m very much a person that has to stimulate my brain and keep myself occupied. Luckily for me I have the BD members and you lot to do that for me.

SCAM

In the seven years I have been doing YouTube videos I have received a lot of positive feedback and comments. It makes all the effort worth it. However from time to time I will receive the odd comment from someone calling me a ‘Scam’ No doubt some of you approached this course expecting it to be another online “get rich quick scam”, so let’s take a look at why this might be.

Labelling something a “scam” is a prime example of how a closed minded person responds to success. Sure, some people run scams and become rich that way, but these people account for a very small percentage of the wealthy. So why do people jump to this conclusion when presented with someone doing well for themselves? The sad truth is because they would rather discount the person’s abilities and belittle their success, than reflect on their own lives and learn how it can be improved. It gives them an excuse to continue living the way they’re used to, and a justification as to why they should. We see this excuse used frequently in reference to those offering any kind of education. If you google Robert Kiyosaki, Tony Robbins, Tim Ferriss or anyone proven to be successful and offering their knowledge to others, you’ll no doubt see the word scam in the search results.

I normally do not follow any other Forex trader as when I trade I like to only focus on my decision making, and not be distracted by anybody else. As someone who runs a business in this industry and works with many institutions and brokers, I get the opportunity to see the latest trends in the Forex Industry. Its a fact that if you promote massive returns and profits in Forex, then it will attract attention. A quick search on Youtube and you will see exactly what I mean. The videos with Thumbnails like turning $1000 into $10,000 every week, will likely get more views than an Video that actually involves real valuable training. This is why I never really share my trading profits publicly as I feel it would be misleading. I tend to trade small accounts, and show everyone my Risk per Trade and Win ratios rather than my large account. The simple reason for this is because trading a $100 account is completely different to trading a $100,000 account. Making a 10% return on a $100 is very impressive, but trying to do that with a 6 figure account will be a totally different story. Emotions come into play and that is why I do not promote it as it encourages bad trading.

Compounding $3000 to $1,000,000 in a year!!

I was browsing through Facebook the other day when I found a post from a trader who made a video on 3K to 1M in 12 months from Forex Trading. Over the last few years I have noticed that many aspiring traders get into the industry thinking they will be able to generate 30,000% returns like this every year. I suspect those who market “magic trading strategies” have a lot to do with this common misconception. My course was written to train up professional traders, and leave the fluff at the door – with this in mind, lets crunch some numbers: If a strategy was able to generate 30,000% per year, it’s safe to say we’d all like to know about it. Not only you and I would be interested, but just about every investor on the face of the planet. In this day and age, a million dollar investment is not that uncommon. So what if I could invest a million dollars at 30,000% per annum for just two years?

Year 1: $1,000,000 x 30,000% = $300,000,000

Excellent, I made a quick 299 million profit in year one. I choose to reinvest my capital again

for year 2! After all, who wouldn’t if they had a 30,000% strategy?

Year 2: $300,000,000 x 30,000% = $90,000,000,000

In just 2 short years I would be worth around 90 Billion dollars – making me, by far, the richest person on the planet. Can you see how this is just blatantly unrealistic?

If you are thinking about taking our course to “get rich quick”, I’d consider saving your money. Trading, the way I teach, is a powerful wealth creation tool that can generate strong percentage returns, and a great passive cash flow. I trade low risk/low reward positions consistently over and over again while compounding returns does the hard work for us. This is what now brings me onto the name of this topic. Compound Interest.

Consistency is the key

Your goal as a trader is to make profit on a consistent basis. Many people may see the word “profit” and consider it to be the most important part of that statement. However, this lesson will show you how consistency is by far the most important element in successful trading. There are numerous stories of people who make impressive profits on a particular trade- yet if you looked at their account statements, you would see that this is merely an anomaly, and the reason they are telling the story in the first place is because it rarely happens! Fortunes are not made from taking huge profit at high risk, but instead by taking small profits regularly and consistently. Although it may sound like a very conservative approach that lacks the glitz of high risk/high reward trades, you will learn that generating steady returns on a consistent basis is the best way to create sustainable. I often get comments from uneducated traders who laugh at me for aiming for 10-20 pips per trade, but at the end of the day its me who is driving the Lamborghini not them. Targeting small pips, means I’m in and out of the market in a short period of time, and my risk is reduced massively. I tend to avoid the market manipulation trap as I’m out of the market before that happens.

At the time of writing, Warren Buffet is the worlds’ third wealthiest man, with a net worth of 47 billion US dollars. Starting with nothing, he amassed his fortune solely by investing. According to Mark Tiers´ book The Winning Investment Habits of Warren Buffett & George Soros, Buffett has averaged a mere 24.7% per annum since the beginning of his investing career. It is the compounding effects of such conservative investing that make it such a lucrative endeavour. To illustrate the power of compounding, I have prepared an example below.

If you were able to invest $10,000 with Warren Buffet at the start of his investing career, you will have returned around 25% per annum on average. This means your initial $10,000 investment will have increased by 25% each year.

End of Year 1: $10,000 + 25% = $12,500 (an increase of $2,500 this year)

End of Year 2: $12,500 + 25% = $15,625 (an increase of $3,125 this year)

End of year 3: $15,625 + 25% = $19,531 (an increase of $3,906 this year)

End of Year 4: $19,531 + 25% = $24,414 (an increase of $4,882 this year)

End of Year 5: $24,414 + 25% = $30,517 (an increase of $6,103 this year

Your investment is not only growing steadily each year, but the rate at which it is growing is increasing exponentially. This is the power of compound interest. A $10,000 investment made with Warren Buffett in 1956 would be worth around $2,700,000,000 today. That is all made from a small 25% return per year. In real every day trading that is 2% return per week. If your Take Profit in Trading is always 1 or 2% of your account, that figure is very much achievable.

As you can see from the example above. Compound interest is your key to financial freedom. Winning big trades is not!

It is very unlikely that you will ever become financial free just from Forex Trading alone. Financial freedom comes from years of investing into passive income streams. If you are a full time trader and you only source of income is from Forex Trading then unfortunately, your going to have to work on your investment skills. One of the first things I got caught from my mentor when I got into trading, was to create a money machine.

A money machine is essentially something that generates money regardless of what happens to you. Even Forex Trading has its negatives when it comes to creating a money machine. Forex Trading is considered semi passive income. Even though the work involved can be very little, and can be done from anywhere in the world, you still have to do something. This is why you need to learn to invest the profits you make from trading. The end goal for everyone who begins their trading journey should be passive income streams, and its important you understand both of these, plus the normal mainstream incomes.

Pure Active Income – This is income that is directly linked to your time input. Anything that pays an hourly wage.

Semi Active Income – This is income that is either generated from a day job or self employed business. If you work for a company and you earn a salary which is not fixed by the amount of hours you work in a day. A self employed business where you have to physically work each day, but have the freedom of choosing what hours you work.

Semi Passive Income – Income that requires less than 7 hours per week.

Passive Income – Income that requires no time input.

This is why I encourage everyone I know to get into trading, because it will teach you a lot about money and investing. Trading Should be considered as a path to greater and bigger investments. A person who I would consider is financial independent is someone who has a well balanced investment portfolio. Forex Trading can make you a lot of money, but what happens if you get blind? Your income disappears. This would be the same if you invested all your money into property, and then suddenly the housing market crashed. This is why its so important to take what profits you can from the markets ,and invest them into different asset classes to create a balanced investment portfolio. A well balanced investment portfolio will continue to generate you profits regardless of what is happening in the world economy.

Stage 1 – Financial Independence

Stage 2 – Maintaining Financial Independence

Financial Independence

Most traders when they go into trading, do not actually set themselves a goal or target. They just have a dream that they will become financial rich some day from it, without actually having a plan on how to achieve that. Understanding what it actually takes to be financial independent will help you map out your success in trading. Financial independence is your independence from a boss, job, partner, parent or spouse. Reaching the first stage of Financial Independence means generating enough passive and semi-passive income to cover your cost of living.

Forex Trading is considered semi passive income. If you are successful at trading, it allows you to have full control over your financial situation, and gives you independence from a boss or job. However it is not true passive income as you still have to put work in to able to make profits. The good part is though, those profits can be made from anywhere in the world.

Maintaining Financial Independence

Maintaining Financial Independence is the ability to maintain Stage 1 Financial Independence regardless of market, mind, motor skills or mortality. Reaching the second stage of Financial Independence means:

- If the market crashes, your income stays put.

- If you lose your mind, your income stays put.

- If you lose motor skills, your income stays put.

- If you lose your life, your income stays put.

This is true passive income, and considered the Jewel in the crown when it comes to income. Learning to invest your money, is the best skill you can ever learn. Money if invested correctly can work 24,7 for you, and is the best employee you will ever have. You also need to remember that Pure passive income flows in regardless of your time or geographic location. A dividend is an example of pure passive income. At the time of this writing, if you own shares in the Ford Motor Company, you will receive a 5% annual dividend. In other words, if you have a million pounds invested with Ford, you will receive a £50,000 per year passive dividend income. That is more than the UK average salary, and you are doing zero work to achieve that.

This income keeps flowing regardless of the time and space of your physical body.

Let your Money Grow…

The main reason I’m telling you all these things is because I want to focus your mind on keeping trading simple. There are so many traders out there that like to over complicate it, and believe the only way to make profit is to learn some institutional secret bank strategy. My Trading goal has always been the same… Take a trade, make money and get out. What ever money I make from trading I will withdraw it and invest it, so it generates me more money. I mentioned earlier that I run a business in this industry, so I have the luxury of seeing trading from both sides. The real money in trading is the one that retail traders put into their trading accounts. Even on the high institutional level, its pretty much the same thing. The only money being risked is the one from pensions and retail investments. Its the average person on the street who is risking their money.

Look at it like this… You have saved up $1000 and deposited it into a trading account. The ‘real money’ is now sitting in the brokers bank account for them to invest and generate their own profits. Now every time you place a trade and make money, yes in theory you are making money, but its all fake money until you can withdraw it. Its just a number on your trading statement that is all. I got taught from day one that if you want to be successful to a point where you have so much money you do not know what to do with.

Control the flow of money, not own it.

So when it comes to Forex trading, who is controlling the real money??… You guessed it! The brokers and banks.

That is why when you make a profit its important you withdraw it, and keep it in your bank account ready for investing. You want to be controlling the money not the other way round!

The Three core principles

Before we move onto the next section I want to break down what your going to learn in this course, and how your going to learn it. As explained previously my three core principles to trading is..

Keep it Simple, Make Money, Get out!

That is exactly what I’m going to teach you in this course. If you want to learn a complicated way of trading which makes you look good on YouTube Videos then you would be best off going somewhere else. However if all you want to do is to make money, so you can withdraw and enjoy it, then you are in the right place. The next section to this course is going to teach you the power of building accounts up properly. Before we ever step foot on the charts, I want you to re-wire your brain to understand that consistency is key. You are not here to make big trades and big wins. Your goal here is to make money and enjoy it. As I mentioned in the previous section your biggest weakness is going to be yourself. The next 6 months of your learning is going to be a roller coater of emotions. Frustration, angry and perhaps greed too. Trust me I have been in your situation so I know how it feels. However my goal here is to keep trading simple for you and break down the steps needed to withdraw a profit from this industry.

The Golden Goose

Do you remember the story of the goose that laid the golden eggs?

On the brink of bankruptcy, a poor farmer and his wife found a very special goose with an incredible ability. Instead of laying regular eggs, this goose laid eggs made of solid gold. Each day they would take extra special care of the goose, ensuring he was well fed, well groomed and had plenty of nice soft grass to lay his eggs. Weeks went by and the goose continued to lay a golden egg each day. The farmer and his wife had began selling the eggs and started to grow rather wealthy. They upgraded their house and farm, bought more land, more cattle and more tractors. Soon, the man and his wife became complacent with their new found wealth and thought the goose wasn’t laying the eggs fast enough. They supposed that it must contain a vast number of eggs inside of him, and decided by cutting him open, they could retrieve all the gold at once! Having done so, they found to their surprise that the golden goose differed in no respect from any other goose. The foolish pair, thus hoping to become very rich all at once, deprived themselves of the gain of which they were assured day by day.

There is a certain belief in mainstream society that obtaining a “big lump sum of cash” means you’re set for life. If only you could make a few million dollars, then you could live freely and never work another day in your life, right? People envisage a 7 figure bank account or a massive vault filled with cash that they can draw from until the day they die. This is one of the biggest misconceptions of wealth that there is. Sure you can draw from your kitty but it’s probably the worst thing you can do. By doing so you are slowly killing your very own golden goose.

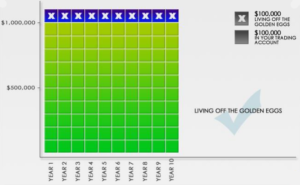

Lets say Neil stumbles across $1,000,000 which he decides to put in the bank and draw from. He figures he could live pretty comfortably off $100,000 per year. The problem is that he could only survive for 10 years, then he’d have to go back to work! Another critical aspect to consider is inflation. Every year our money becomes worth less, as more of it is printed and brought into circulation. Even at a rate of 3%, inflation is indirectly costing Neil around $30,000 a year. The truth is that if he had $1,000,000 in the bank, he could probably only actually last around 7 years.

Now we’ll take a look at Luke, who has also just stumbled across $1,000,000 which he decides to invest. Luke only needs to make 10% over the course of a whole year in order to to make $100,000 which can afford him a very comfortable lifestyle. Over the year he has the same quality of lifestyle as Neil, but instead of cutting into his kitty, he lives on the returns instead. At the end of the year Luke still has his $1,000,000 golden goose which produces $100,000 per annum. He can hypothetically live off these returns comfortably for the rest of his life, and pass the golden goose on to his children and his children’s children.

Your life savings and trading account is your golden goose, and cashflow is the egg it produces. Never kill your golden goose! Put it to work and grow it big and strong so you can live off the eggs. Society tends to portray “net worth” as the real measuring stick of riches, however those who have achieved financial success realise that it is, in fact, cashflow which is the “holy grail” of true wealth. I have met people who have spent their entire life acquiring $10+ million property portfolios, yet struggle to pay for a nice dinner in town. On paper they’re the amongst the wealthiest 0.5% on the planet, however net worth does not necessarily put food on the table or fuel in your car. On the contrary, I know young traders who have a very modest investment portfolio, yet are able to consistently generate $10-15K cashflow per month. Who do you think leads a better lifestyle? This brings us to the next idea – my flagship concept…

Everyone on earth has a different threshold as to what they define as “rich”. Who you think is rich, I may not, or vice versa. Despite whether we measure it in terms of net worth or cashflow, we always relate wealth (or prosperity) to someone’s financial situation, and for good reason: The dictionary defines rich as “having wealth or great possessions; abundantly supplied with resources, means, or funds”. Likewise, the dictionary definition of prosperity is “a successful, flourishing, or thriving condition, especially in financial respects”.

The issue, however, with measuring someone’s wealth or prosperity in terms of money, is that monetary figures are relative to individuals and the economic environment in which they reside. For example, a million dollars to Donald Trump is simply not the same as a million dollars to the average child in Africa. Likewise, a million dollars does not have the same purchasing power in America as it does in China or India. The affect of money in a persons life is completely relative to the person in question, therefore it is unfair to evaluate any two

peoples level of wealth in terms of a monetary comparison. To compare any two things fairly, you need to define a “common denominator” between them and make the comparison in relation to this “common denominator”. Usually we do this subconsciously, without even knowing we’re doing it. For example, saying John has a higher IQ than his dog Bella may be a true statement, but the comparison has no value as there is no relevant common denominator between the two subjects in question. However, saying John has a higher IQ than his friend Mary may be a true statement, and presents a certain amount of value if, for example, you were choosing between the two to join a trivia team. This is because the comparison has a relevant common denominator: Two students who wish to join a trivia team.

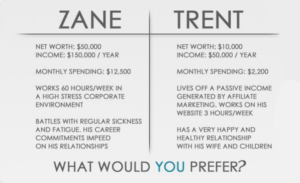

Besides being human, there is not many things that each and every person on the planet have in common. People differ in race, gender, religion, location, nationality, hair colour, eye colour, body type, personality and in just about every other way possible. This presents an issue when it comes to fairly comparing any two people in the area of wealth or prosperity. We have already established that dollar figures are relative to each person individually, so saying Zane is richer than Trent because he has a bigger bank account and more income may be true, but it won’t necessarily be a fair comparison. To fairly compare their real wealth, we need to find a common denominator between Zane and Trent. It has been said that time is more important than money, so why don’t we measure wealth in terms of time? As far as I know, everyone on the planet has around 24 hours in each day and about 365 days in each year, making time one of the few common denominators of every person on the planet. Members of the “New Rich” no longer measure wealth with the monetary figure of net worth or income, but with the amount of time someone has. We are not implying by any means that the dictionary has it wrong, instead we are simply offering a new way to look at the concept of riches, wealth and prosperity.

The “New Rich” definition of wealth and prosperity is the amount of time one could live the way they would like to live without having to physically work.

By measuring wealth in terms of time, it shifts the focus from attaining “more money” toward attaining more freedom and spare time to do the things you love. Unfortunately, most employees only have a New Rich wealth of around 1 or 2 weeks, meaning without their regular pay check coming in they wouldn’t be able to survive.

The “New Rich” realise that it is not the amount of money in your bank account or the income you earn that makes you happiest, it is the freedom and the lifestyle that the money can provide to you, considering your needs, desires and circumstances. In closer review, after removing the glasses of social conditioning we realise that despite Zane having more money and more income, it is Trent that leads the more happy, fulfilling and prosperous lifestyle. Why is this being discussed in a goal setting lesson? The truth is that in mainstream society, Zane is seen as being very “successful”. Unfortunately, most of our parents and teachers were raised during a time when success was determined purely by your pay check and area of profession. The world simply doesn’t operate like that these days, and unless you have heard or read about the New Rich in your travels, chances are your biggest influences in life all have outdated ways of thinking that they have imparted on to you.

It would be negligent of us to have a financial goal setting lesson if we didn’t at least mention the existence of a small group, the “New Rich”, who set financial goals completely differently to those who were raised and educated in mainstream society. The harsh truth is this: Most employees who make it to the upper-income bracket and are “successful” in the eyes of the majority still only have New Rich wealth of around 1 or 2 months. If you took away their pay check, they would only last around 1 or 2 months before running out of cash. In my opinion, this isn’t success at all. Besides a 1 or 2 month buffer they have saved up, their time on earth is completely governed by their need for cashflow. Although some people claim to love what they do, always remember there is a big difference between wanting to work, and needing to work.

Earlier in the lesson I mentioned that cashflow is the holy grail of wealth. After discussing the New Rich, I wish to clarify that statement:

Passive cashflow is the holy grail of wealth

Passive cashflow is simply income that trickles into you bank account 24 hours a day, 365 days a year which requires very little to no work on your behalf. Having a strong passive cashflow allows you to live freely, and live life on your terms. It encourages you to broaden your horizons, find your passion and share your knowledge with others. Most students are convinced that they want a successful career, when in fact all they really want is passive cashflow to support them while they find their true calling in life.

I strongly encourage you to to begin working towards increasing your passive cashflow. Although swing trading requires a few hours a week to manage, I still count this as passive. Let’s be honest, you’re simply identifying patterns and clicking buttons.

You want to measure your New Rich wealth in months. In the worst case scenario, if you had no pay check coming in, this is how long you would last before running out of cash. The reason I say worst case scenario is because this calculation implies that you will cut in to your “golden goose” to survive. Your primary financial goal should be to grow your passive cashflow to the point where it exceeds your required monthly income, without cutting into your golden goose.

Once your passive cashflow has exceeded your required monthly income, you can live indefinitely without needing to work. Your New Rich prosperity will reach a level that can no longer be measured in terms of days, weeks or months. It is truly infinite. This is a powerful phenomenon!. On the subject of goal setting, it is my goal to help each and every one of my members to achieve this level.